Hard Landing, Soft Landing, or No Landing at All?

By Steven Fraley, CFA, MBA & Nancy Rimington

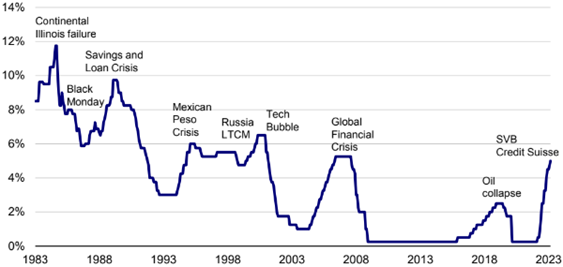

Equity and bond markets are often impacted by global events and the overall health and direction of the economy. This has been increasingly relevant over the last few years amidst a global health pandemic, a war in Ukraine, and the highest U.S. inflation in more than 40 years. Recent failures of Silicon Valley Bank and Credit Suisse have have contributed to an understandable dip in consumer sentiment. This shaken confidence can lead to increased concerns and fears about what’s to come and cause a ripple effect in investment markets.

While inflation in the U.S. appears to be under less pressure than just a few months ago, fears of sustained higher interest rates and, ultimately, a recession are still on the minds of many. The markets are climbing a wall of worry and consumer sentiment is near an all-time low. But it isn’t all negatives ahead, and where markets go from here really depends on a few possible outcomes.

The first consideration is whether we experience a hard landing, where the economy experiences a sharp contraction, ultimately leading to a recession. This scenario is often precipitated by a financial crisis and would result in significant declines in corporate earnings and economic growth, likely pushing interest rates and equities meaningfully lower.

A soft landing is also possible, where the Fed successfully maneuvers the economy into a gradual slowdown, with inflation moving towards the long-term target of 2%. In this scenario, rates will likely move sideways or come down slowly and equities could potentially move higher. While this is certainly the most desirable outcome, the deep inversion of the yield curve this year puts the odds of a soft landing more diminished.

A third scenario would be where there is essentially no landing at all, where the economy remains relatively strong, inflation remains above trend, and the Fed is forced to hike rates more than expected. For each of these outcomes, the impact on client portfolios and asset allocation could be very different.

Source: Lincoln Financial

We don’t know what will happen from here, but history has demonstrated that when investors have reached low points in optimism about the direction of the economy, stocks have typically ended much higher, on average, just one year later. Additionally, following substantial declines in the stock market (over 25%, peak to trough), patient investors have been rewarded with very robust long-term performance (3-, 5-, and 10-year) in subsequent periods. While we can’t predict future returns, history suggests that there is a high likelihood of strong stock performance after periods of market declines, and that recessions ultimately set the stage for the next period of economic growth.

January economic data seemed to give investors more confidence in a possible soft-landing scenario, though February data caused investors to wane, indicating a more resilient economy and stickier-than-expected core inflation. As we entered March, central bank policy and geopolitical uncertainty were key themes still dominating headlines, with continued concerns over the possibility of a recession in the coming months.

What does all this mean for your investment portfolio? Our approach with clients has always been focused on process, not prediction, and reiterating the importance of diversification and a long-term mindset. While traditional stocks and bonds serve an important role within a diversified portfolio, alternative asset classes can help volatility and provide a different return stream than traditional asset classes. Inflation-hedging assets like mid-stream energy, infrastructure real estate, and other real assets can play a huge part in portfolio exposure; they provided significant downside protection in 2022.

Exposure to high quality fixed income and cash not only can help provide downside protection during an economic contraction or hard landing scenario, but now provides meaningful income generation in portfolios. Deflation hedges are more commonly found in areas like fixed income and are perhaps more attractive now due to the rise in interest rates, especially within high-quality/intermediate and long-term fixed income investments.

To date the Fed has raised its benchmark rate by 4.75% since March of 2022, marking the fastest pace of rate hikes since the early 1980s. Almost all previous rate tightening periods have resulted in some sort of financial crisis, and this time appears no different; evidenced by some significant stresses in the broader banking system.

Sources: (Chart) Invesco, US Federal Reserve. Data as of 03/31/2023.

Economists are debating whether the aggressive action by the Fed will steer the US economy towards a hard landing and ultimately drive the economy into a recession. As the German economist Rudi Dornbusch said, “economic expansions do not die of old age; they are murdered by the Federal Reserve.” Will this time be any different? Can the fed successfully bring down inflation without an economic downturn and navigate us towards a soft landing scenario?

History suggests that this might be a difficult objective, as the U.S. has entered a recession following the last five periods when inflation peaked above 5%. No matter the outcome, our clients can benefit from following a prudent investment process that reinforces the importance of asset allocation, downside risk mitigation, and focusing long-term.