Could Your Family Benefit From An Independent, Outsourced Chief Investment Officer? Part IV

By: Richard Todd

Analysis of Concentrated Stock Positions

Many families have significant, concentrated positions in low-basis securities. It is typically beneficial from a risk/return standpoint to sell these securities and diversify the portfolio. However, the benefits from diversification need to be weighed against the tax consequences. Careful analysis by an independent party is required to determine an appropriate strategy for these positions, with careful analysis given to hedging techniques, diversification benefits, tax implications, gifting considerations, and other factors. Fees on specialized strategies can be significant, and an independent family OCIO can help to drive down fees by bidding out the proposed solution to various third parties.

Case Study

Taking a Variable Pre-Paid Forward Contract Out to Bid Situation: A family had a large concentrated stock portfolio and needed diversification, liquidity and downside protection. An outright sale would have resulted in a huge tax bill. The family’s Wall Street firm proposed a variable forward contract to hedge the position and create liquidity. However, pricing was not transparent.

Independent OCIO Solution: Although the hedging strategy was a solid idea, transparent pricing and competition was created through competitive bidding from several banks. In the end, the family received significant liquidity for diversification, received cash flow from dividends, protected stock price on downside and saved more than $900,000 in fees and commissions.

Performance Evaluation

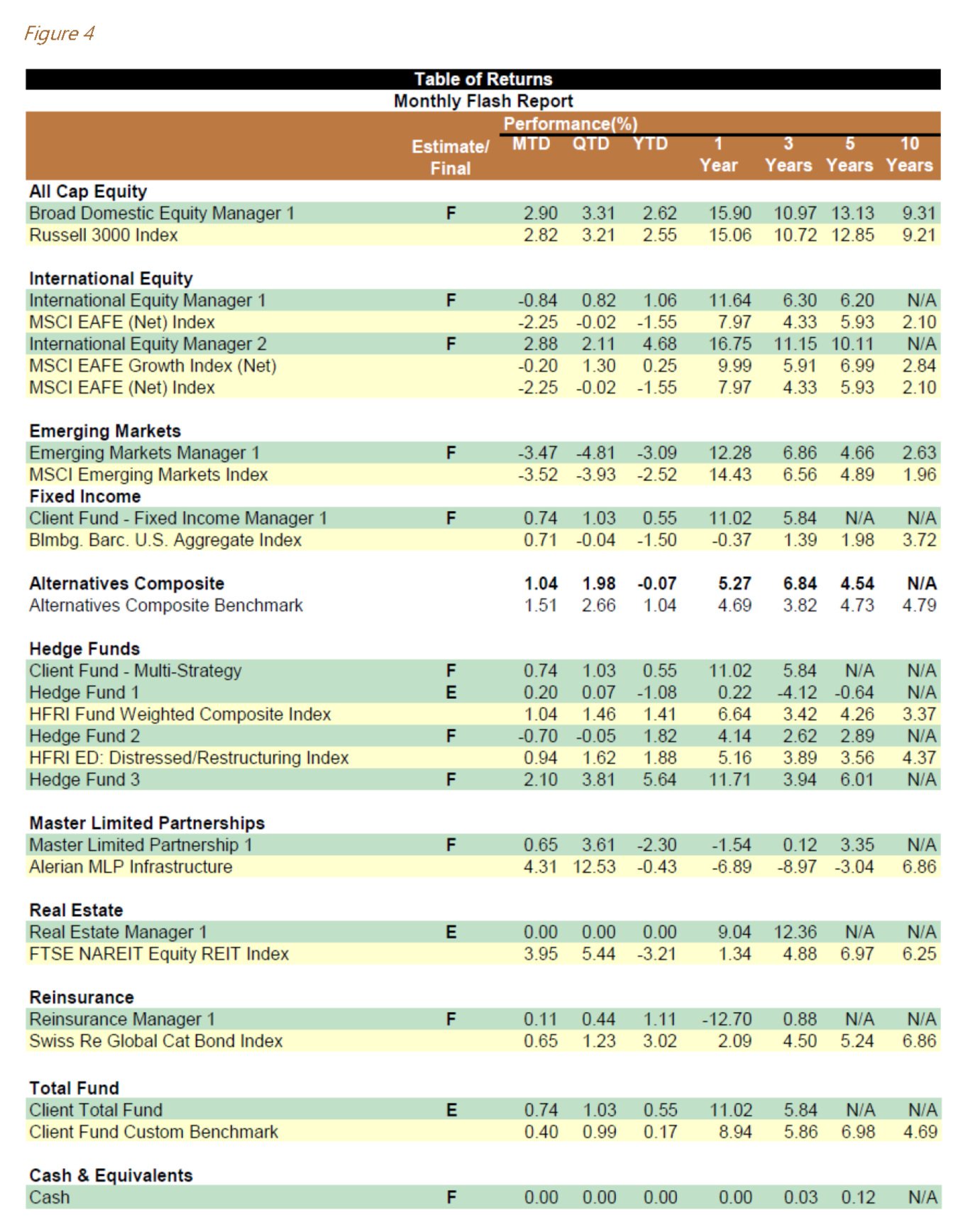

Performance results should be evaluated at both the total portfolio level and manager/strategy level, including comparisons versus appropriate benchmarks.

All investments with their corresponding benchmarks should be reflected in a table to provide an apple-to-apples comparison. Benchmarks should be clearly stated in the Investment Policy Statement. Ideally the independent OCIO’s portfolio accounting software should link to each custodian to receive daily downloads to ensure accuracy. The sample in Figure 4 depicts a simple, but comprehensive, table of returns. Private equity and real estate investment reporting is often inconsistent, especially if the investments are funded through capital calls. These investments should be included in the total return of the combined portfolio, and the internal rate of return should be calculated for each investment. Often, families can overstate their success with private equity, as successes often overshadow poor investments that can drag performance. Accuracy is important to grasp the big picture, and performance can be segmented by sector or strategy (venture, late stage, technology, energy, etc). Please see Figure 5 for a sample of private equity and real estate reporting.

Case Study

Reporting Situation: An extremely security-conscientious individual had many accounts and multiple custodians. The individual also did his/her own trading and had partnerships set up for various family members. This format created the inability to view the big picture of the combined portfolios, including the overall risk/return profile.

Independent OCIO Solution: Custom reporting was implemented which included entering all aspects of the portfolios each month and reflected the ownership of each portfolio within the performance and market values of the individual portfolios. This custom reporting allowed the individual to have a big-picture allocation view, transaction details to simplify tax reporting, custom cash flow that led to catching a miscalculation, and, most importantly, the individual did not compromise his/her security requirements.